In narrow terms, AI may be understood as a process or tool that utilizes complex algorithms and interprets large loads of data in order to solve specific challenges. Broadly speaking, however, AI may be better defined as a transformative culture, similarly to how cloud-native is perceived, which empowers organizations with a range of abilities:

• Transformed pattern detection

• Enhanced foresight

• Flexibility in customization

• Improved decision-making

• Broad communication options

Fundamentally, AI has transformed (and continues to do so) how financial services organizations find new customers and, importantly, keep them; the cost-efficiency of business operations; analytical capabilities and the interpretation of data; the tailoring of products and services to clients, and much more.

From chatbots to risk management, AI has become entrenched in most aspects of the financial services sector and shows no sign of disappearing. In other words, if your business is yet to implement AI within your processes and overall business strategy then you simply cannot afford to wait any longer – should you wish to remain competitive. Indeed, it has been predicted, by 2025, that those financial services companies that utilize AI and augmented technologies will be able to take a slice of ‘$140 billion in productivity gains and cost savings’.

Sounds quite remarkable, doesn’t it? However, you may question how exactly your organization will benefit from the use, or increased integration, of AI – a question this article will aim to answer.

The Big Picture

In the context of financial services, the areas in which AI may be successfully deployed are virtually endless:

• Risk management

• Asset management

• Revenue generation

• Process automation

• Client acquisition

• Alpha generation

• Underwriting

• Fraud detection

• Customer engagement

Perhaps of more value to those organizations who lie on the fence when it comes to the (potentially increased) integration of AI, are the rather eye-opening statistics associated with the perceived importance of such technologies for businesses within the financial services sector alone.

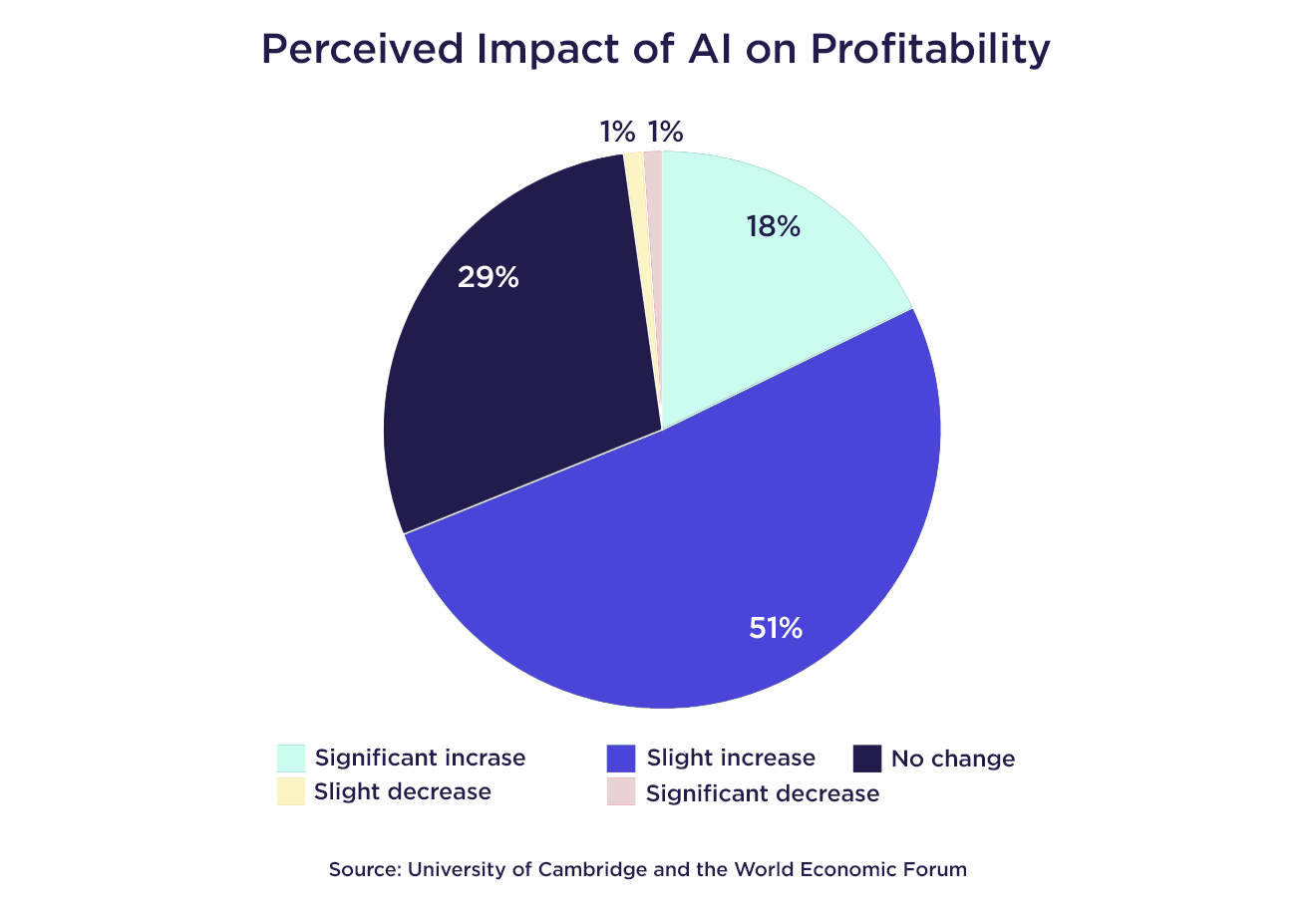

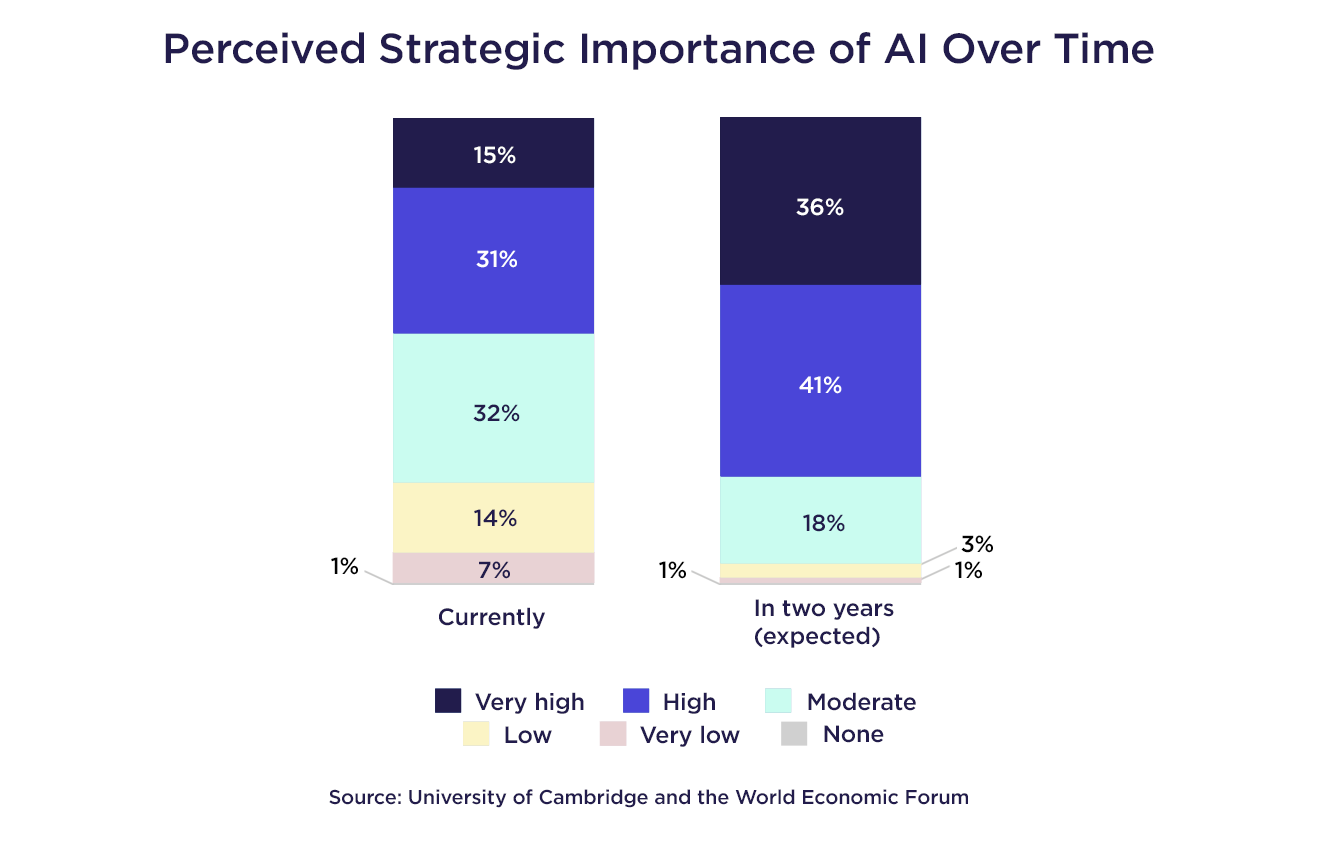

According to a report jointly produced by the Cambridge Center for Alternative Finance and the World Economic Forum, 77% of respondents were found to hold the view that AI would ‘possess high or very high overall importance’ for their business in the next two years. In terms of profitability, 69% of those surveyed claimed that the use of AI had increased revenue (18% reporting a ‘significant increase’, with 51% reporting a ‘slight increase’). Even more interestingly, the vast majority of financial services firms surveyed believed that their profitability had increased where they had put over 10% of their R&D budget toward AI.

How Is AI Being Utilized in Financial Services?

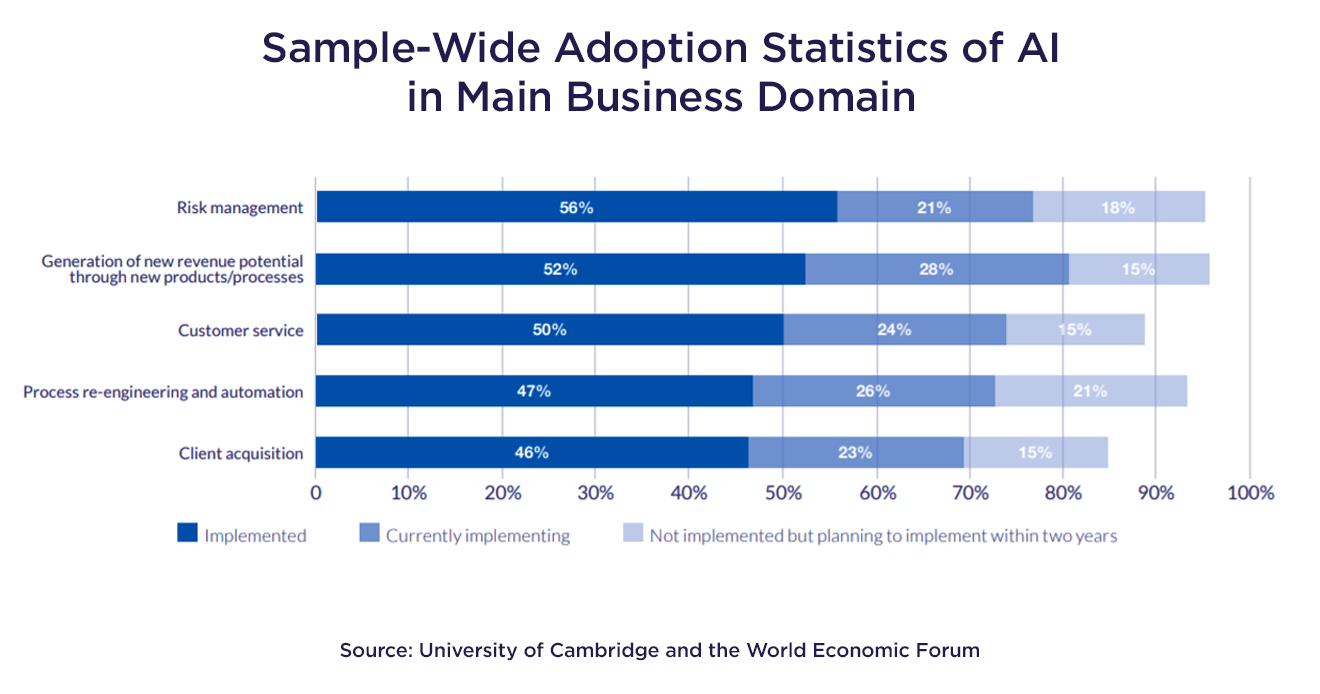

Given that the area of risk management is currently seeing a high level of AI implementation rates (56%), it makes a certain amount of sense that we begin with an analysis of how AI may benefit financial services organizations in this regard.

When it comes to risk management, it must be emphasized that traditional risk models are greatly limited by the assumption that markets act in a linear fashion, in contravention of the more modern understanding of markets (and influential world events) as being anything but. Problematically, however, if organizations are to accept such a reality, they must also plan for the likely eventuality that they have to handle and interpret large quantities of data and the variables inherent. Where AI can immediately make an impact is through its unrivaled processing power and algorithms, which may contribute to more detailed risk analysis, in real-time – potentially supercharging revenue generation.

In short, AI can enable businesses to make better financial decisions, not only within risk management, but also in other areas – for example, fraud detection – through the sophisticated use of data. Kensho is a particularly suitable case in point; if you’ll excuse the use of an event, long-since exhausted through general discourse and political handwringing, Kensho’s database (powered by AI) enabled traders to predict the extended decline of pound sterling following Brexit. Recently, the software was utilized to analyze the effect President Donald Trump’s tweets had on crude oil prices – the value of such analytical capabilities, as you may imagine, are monumental.

Enhanced customer communication is another area in which AI has made its mark. Given that many banks are facing a mounting challenge in meeting customer demand, AI can help such organizations revamp their customer-service models (ultimately cutting costs and improving communication) via chatbots and virtual assistants, with 24/7 availability. AI-powered chatbots can help reduce the pressure on banks’ call-centers, while simultaneously empowering customers to find their own solutions – for instance scheduling payments and checking account activity.

As Dondi Black, of FIS, has expertly summarized, “AI is no longer operational or a ‘best practice’. It is critical to financial service providers who want to remain relevant and competitive in the marketplace of the future.”

How Do VUSE and Cloud Computing Fit Into All This?

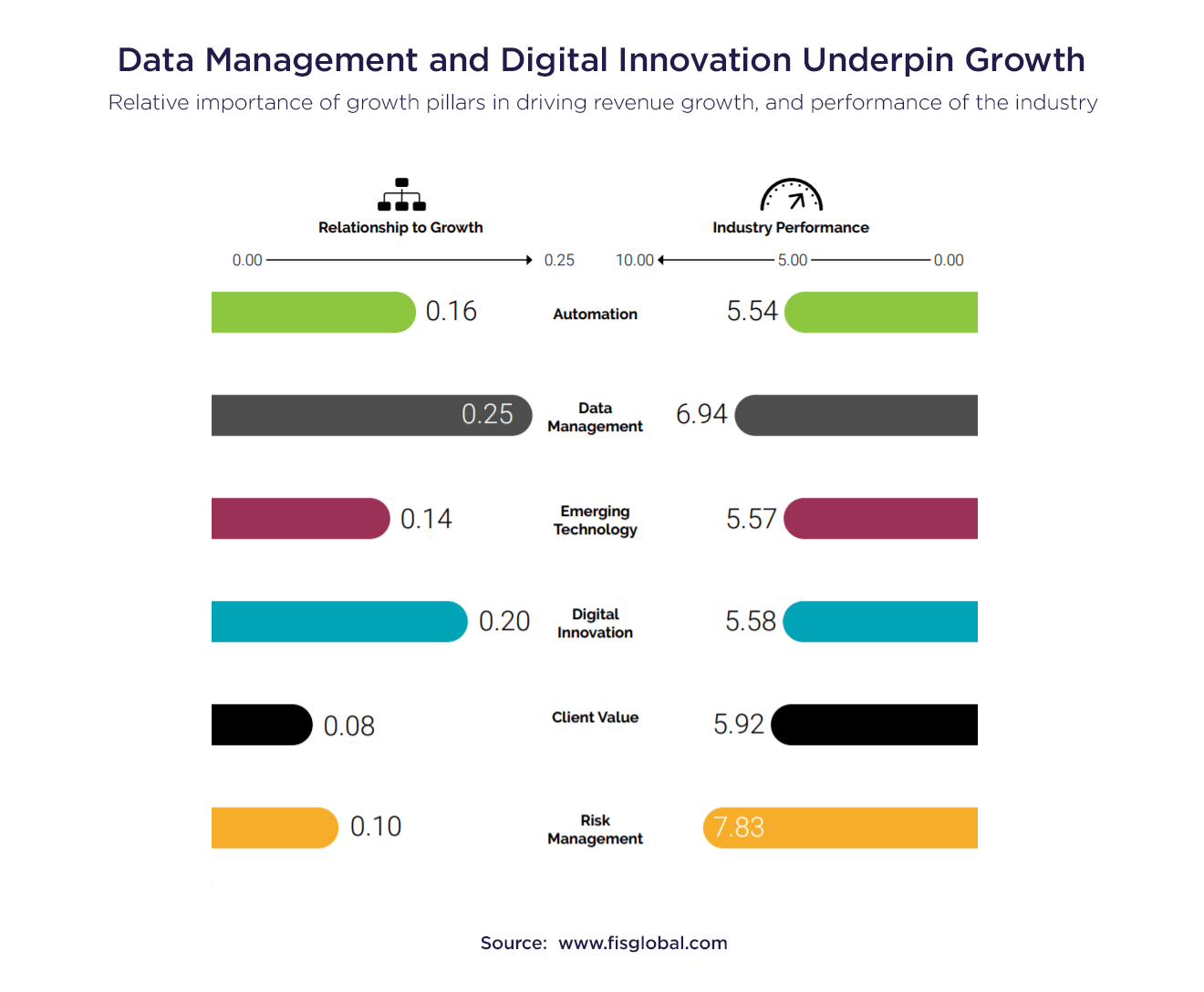

According to a FIS survey of asset managers, digital innovation and data management strongly correlates with revenue generation, a finding reflected by the fact that only three percent of ‘leaders’ in the industry don’t intend to move their critical processes over to the Cloud.

Given the flexibility, scalability and cost-effectiveness of resources that the Cloud has to offer, it would be foolish for organizations not to take advantage of the Cloud whilst also implementing AI. This has been particularly well illustrated within the aforementioned University of Cambridge and World Economic Forum study, which found that the Cloud has become increasingly suitable for AI-underpinned projects, due in no small part to its affordable offering of powerful GPUs critical to the use of AI applications. Therefore, the long and short of it is that your organization is far better off leveraging the power of the Cloud, and all the innovative capabilities attached, in combination with AI, in order to meet your business objectives.

Where AI implementation may run into potential stumbling blocks however, will be in the realm of talent availability (an issue identified in a prior Deloitte study) in relation to an AI-skilled workforce. While there is a need for increased investment in this area, most organizations cannot afford to simply put their feet up and whistle away the time until talent appears – certainly, when it does, organizations lower down the chain will struggle to attract such talent as successfully as their larger competitors.

However, this does not necessarily mean that your organization should just sit back and accept its station in life. A temporary (or longer, dependent on your project and requirements) talent boost through VUSE’s team extension service can offer your organization quick access to certified, affordable developers who can fill skill gaps in your team, enhancing your competitive edge.

Our teams at VUSE are providing solutions to many of the challenges facing the financial services industry (among others). If you want to find out more about how VUSE can help streamline your organization’s digital transformation, utilize AI to enhance your revenue generation, or build software solutions customized to your business needs and ambitions, then get in contact today!